The 2:15 PM Slump: How Much Money You Need to Quit a Job You Hate (Singapore, 2026)

The 2:15 PM Slump

We’ve all been there.

It’s a Tuesday, 2:15 PM. You just finished a meeting that could have been an email, and now you’re staring out of your office window. You’ve been working for a while, you’re tired, and you’re wondering:

“Is this it for the next 35 years?”

You want to quit.

Not because you’re lazy — but because your mental health is red-lining.

Then reality hits.

You remember the $7 cai fan you just ate, the stack of bills waiting at home, and the $1,500 rent or mortgage payment due next week.

It’s 2026, and Singapore isn’t getting any cheaper. Let’s be real — it probably never will.

But freedom isn’t an all-or-nothing game.

Today, we’re not talking about retiring at 65 or hitting $1 million. We’re talking about how to build an “I Hate My Job” Fund — the exact dollar amount you need to walk away, take a break, and find yourself again.

$7 Cai Png?

The Difference Between an Emergency Fund and a Freedom Fund

Most financial advisors tell you to save 6 months of expenses for emergencies — things like medical bills or retrenchment.

But a Freedom Fund is different.

It’s PROACTIVE, not REACTIVE.

Think of it this way:

An Emergency Fund keeps you alive if you get fired

A Freedom Fund gives you the power to fire your boss

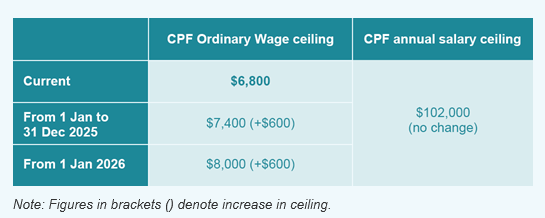

With the CPF changes that took effect on January 2026, the salary ceiling is now $8,000. If you’re a high earner, you will probably notice your take-home pay dip.

Back in 2025, on a $8,000 salary, you brought home $6,520.

In 2026, that number is closer to $6,400. Which means we might have less cash on hand, especially if you are earning above $8,000 a month. You “lose” $120 to CPF.

The silver lining? Your OA and SA are growing way faster, but it also means we need to be much smarter with the cash we actually have left.

The Math — Finding Your "Monthly Survival Number" (MSN)

Since we now have less money sitting in our bank accounts, the next question is:

How much do we actually need to survive each month?

I call this the Monthly Survival Number (MSN) — and yes, I really hope one day millennials will appreciate this joke.

Here’s the good news:

You don’t need a million dollars.

How much you need to survive a month + buffer!

Once you know your MSN, freedom suddenly feels a lot closer than you think.

Here’s my own "real-life" breakdown as a case study. This is based on my lifestyle, so your numbers will differ and that’s totally okay!

The 4 Core Spending Categories

Fixed Expenses

This includes utilities, mortgage, rent, and mobile bills.

Mortgage (paid via CPF): $1,000

Utilities: $50

Mobile plan: $18

Total cash out: $68/month

Survival Expenses

This is mostly groceries and daily food.

I spend about $400 a month on my Trust card. I love cooking, and I always over-buy ingredients. CDC vouchers help, but they don’t last forever, and I expect this number to rise over time.

Insurance/Protection Expenses

This is my most expensive category.

I have a medical condition, which means higher premiums for some policies.

Across all my insurance plans, I’m paying about:

$600/month

Sanity Fund

This is where most people underestimate their spending.

For me:

Netflix + Adobe: $50

Dining (December): $1,169

Transport (bus, MRT, private hire): $400

Gym membership: $300

Total Monthly Survival Number (MSN)

When you add everything up, my MSN comes to roughly:

$3,000/month

And realistically, this number will only go up over time due to inflation and shrinkflation.

The Freedom Fund Formula

Here’s the formula I use:

(Monthly Survival Number × Months of Freedom) + 20% “Oh Sh*t” Buffer

If I want 12 months off work to reset, recharge, and recalibrate:

$3,000 × 12 = $36,000

Add 20% buffer = $43,200

That’s my Freedom Fund.

Suddenly, this feels a lot more achievable than chasing a vague $1,000,000 number.

Where to Put the Money? (Core vs. The Wildcard)

Saving $43,200 overnight isn’t realistic — unless you stop eating and paying your mortgage, which I don’t recommend.

Leaving everything in a bank account also isn’t ideal, especially with interest rates falling.

So I split my Freedom Fund into three buckets.

Bucket 1: The Foundation (70%)

This is the boring but stable part.

I’m currently using Trust Bank with an NTUC membership, earning about ~1% interest with card spend. Not amazing, but safe.

Alongside that, I’m also building a stablecoin pool.

I hold some USDC earning around 3.5%, with interest credited live. The nice part? I can easily transfer funds to my Ready card, which works like a normal debit card.

This bucket prioritises liquidity and stability.

Bucket 2: Mid-Risk Growth (20%)

This is my small investment account.

Money here goes into:

STI ETF

Local dividend-paying stocks

The plan is to stay invested long-term, collect dividends, and let capital gains compound quietly in the background.

Bucket 3: Wildcard Plays (10%)

This is the optional accelerator.

For me, this includes crypto — high risk, high volatility.

If BTC goes up, I accelerate my path to freedom.

If BTC goes down, it only sets me back by 10%, not my entire plan.

The Pre-Quit Checklist (Don't skip this!)

Hitting your Freedom Fund doesn’t mean you resign immediately.

Before quitting, there are two critical steps.

1. Max Out Your Medisave

In 2026, the MediSave cap is $79,000.

Once you hit this cap:

Any future CPF contributions or interest spill into Special Account (SA)

Your retirement nest egg grows faster

Your healthcare buffer becomes effectively bulletproof

This is a massive, underrated milestone.

2. Do a “Test Month”

Before quitting, run a test month.

Live your life strictly within your MSN and see how it feels.

If it feels miserable, your number is too low.

Adjust before you buy freedom — not after.

Conclusion: It's Not About the Money, It's About the Choice

The “I Hate My Job” Fund isn’t about being rich.

It’s about knowing that if your boss screams at you tomorrow, you have the financial oxygen to stand up, walk out, and say:

“I’m done.”

Money is just a tool to buy back your time.

Start building your foundation today, and that Tuesday afternoon slump won’t feel nearly as heavy.

Stay safe, invest safe, and I’ll see you in the next one.