Ready Crypto Card Review: Is the $120 Metal Tier Actually Worth It?

One of the biggest problems crypto investors face is getting their money out. Moving gains from different platforms and exchanges usually comes with high fees, bad spreads, or the headache of OTC deals that trigger AML (Anti-Money Laundering) checks.

This is where crypto cards come into play. They act as an interface between the crypto world and the physical world, allowing you to spend your digital assets where merchants usually only accept fiat.

I’ve used several cards in the past (like Crypto.com Card and BasedApp), but recently I switched to Ready (formerly Argent). Here is a breakdown of how it works, the yield strategies I use, and whether the premium Metal card is actually worth the price tag.

What is Ready (and Starknet)?

Ready is a rebrand of Argent, an "OG" mobile software wallet. While you can use the wallet for various chains, Ready is built primarily for Starknet, a Layer 2 (L2) solution on Ethereum.

You don't need to be a developer to understand this; you just need to know that because it is on a Layer 2, transactions are faster and cheaper than on the main Ethereum network. Plus, the Starknet Foundation is currently running "DeFi Spring" & “BTCfi” campaigns where they distribute $STRK tokens as boosted rewards for users.

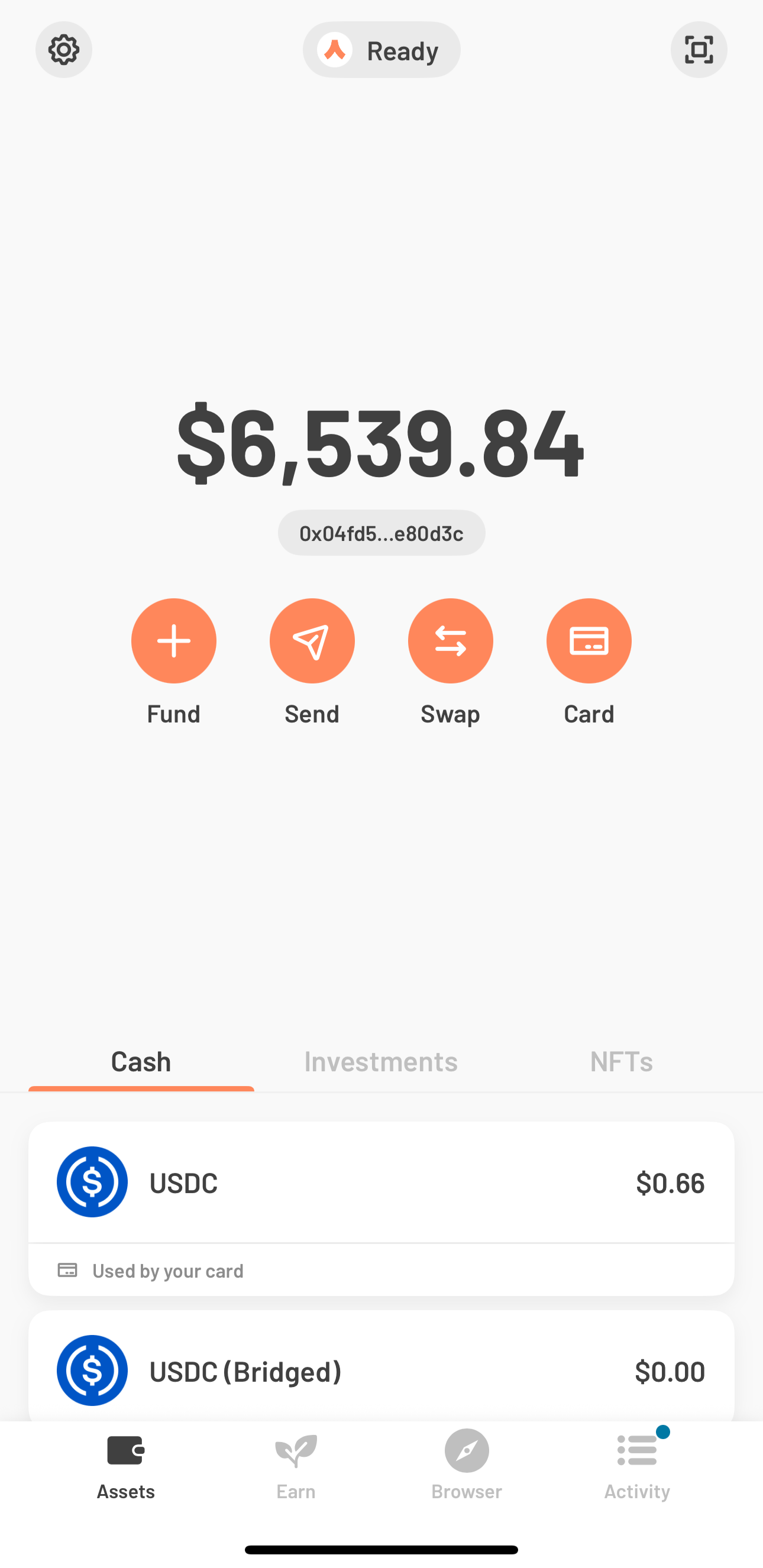

The Wallet Interface

The Ready app is split into two main sections:

Top Section: Your total wallet balance.

You can assign a specific amount of crypto to the "spending" portion of the card, while the rest stays in your wallet earning interest.

Bottom Section: Split into three categories:

Cash: Stablecoins available for spending.

Investments: Coins actively being used in DeFi or staking.

NFTs: Your digital collectibles.

Ready Lite vs. Ready Metal: Which Should You Pick?

There are two tiers of cards available. Here is how they compare:

Ready Lite

Cost: Free (US$6.99 shipping).

Cashback: 0.5% on spend (capped at US$150/month).

Fees: No foreign transaction fees.

Payout: Cashback is paid in $STRK tokens on the 15th of every month.

Ready Metal (Gold/Platinum)

Cost: US$120 per year (paid upfront).

Everyday Benefits:

10% Cashback for the first 30 days (instead of 0.5%) & 3% after.

Zero FX fees.

Free ATM withdrawals.

Exclusive Perks:

Free Bridging: Refunds on bridge fees (via Layerswap).

Travel: 15% off Airalo eSims (very useful for travelers).

Security: Up to 70% off NordVPN (2-year plan).

Other: 30% off Ramp Network fees, Koinly tax discounts, and Nansen analytics.

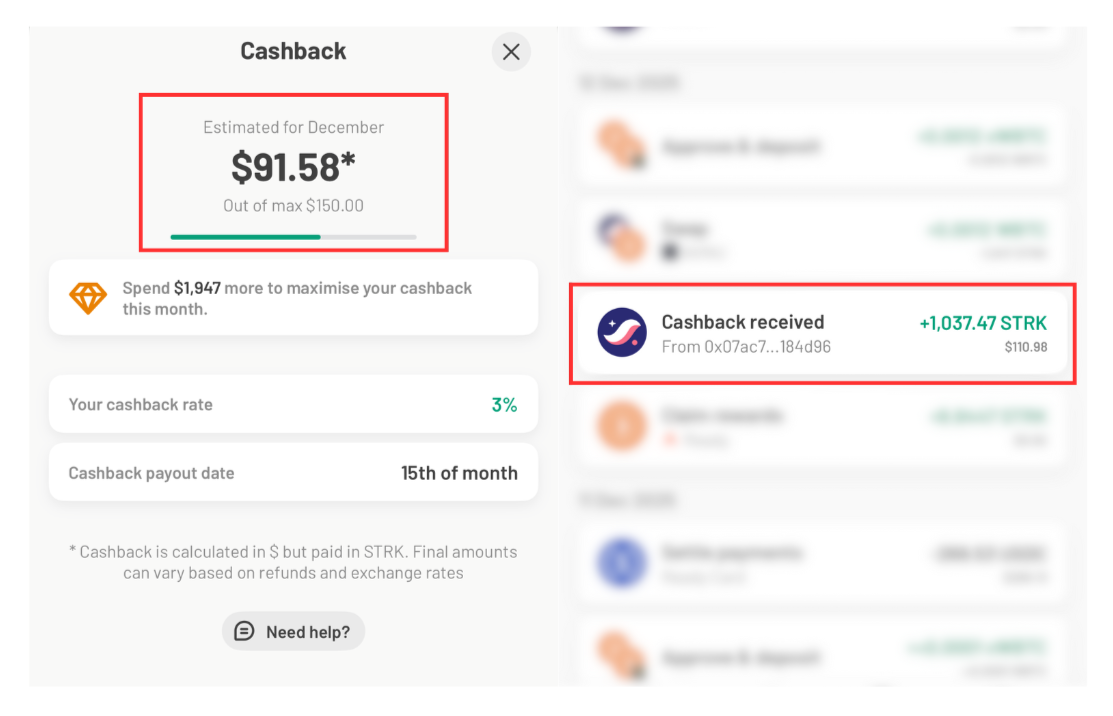

Is the $120 Metal Card Worth It? The Math.

I decided to go with the Gold Metal card. At first glance, paying US$120 a year seems steep, but here is the calculation I used to justify it:

If you capitalise on the 10% cashback offer during the first 30 days upon card activation and max out the spending limit of US$1,500, you will receive $150 in cashback.

Cashback earned: US$150

Card fee: -US$120

Net Profit: +US$30

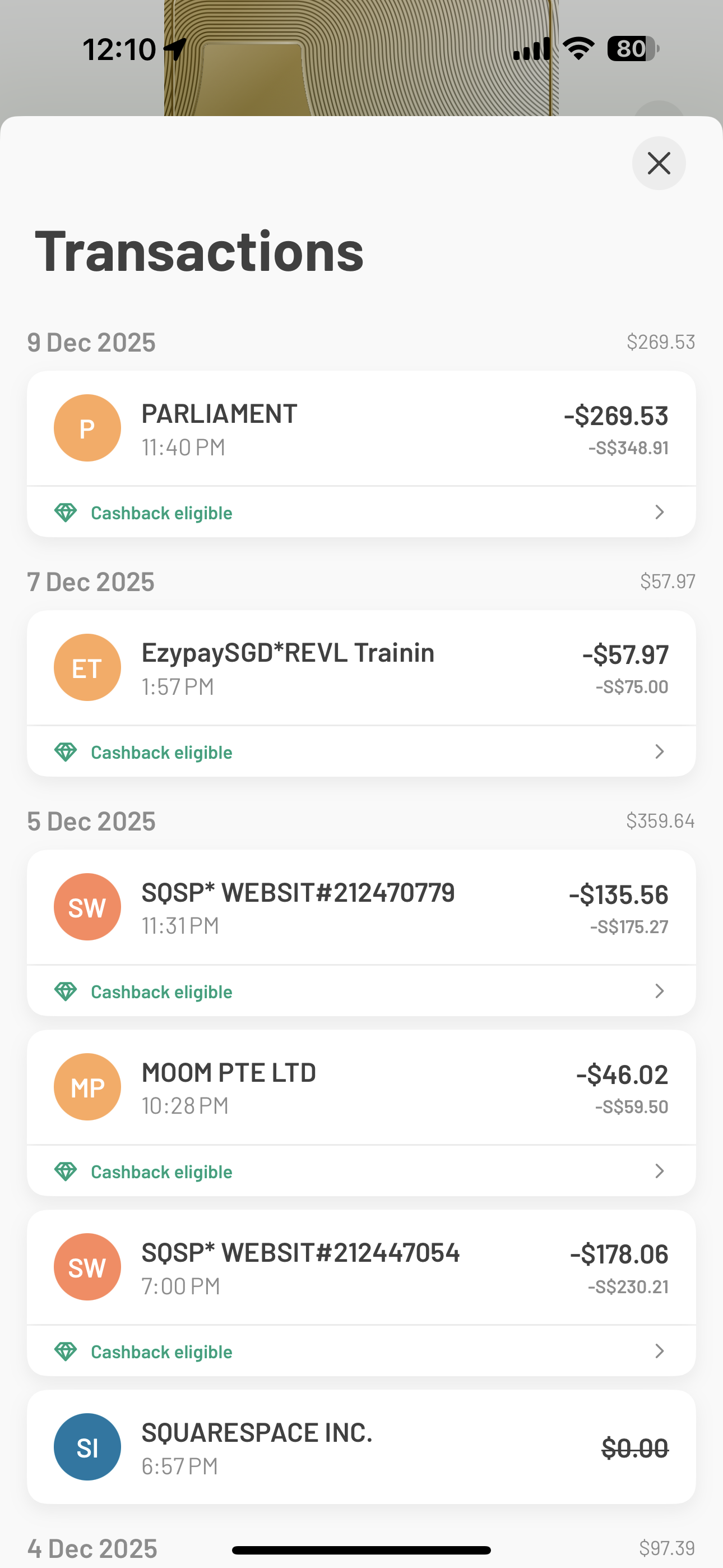

Essentially, the first month of spending pays for the card's annual fee, and you get to keep the perks (like free bridging and eSim discounts) for free for the rest of the year. So far, I have accrued roughly US$200 in cashback over November and December, so the card has already paid for itself.

Total of almost US$200 Cashback from Ready Card so far!

“If you want to try the Metal card, you can use the code YT-305QFU for 30% off your first year.”

How to Fund the Card & Maximize Yield

Before spending, I like to ensure my idle assets are working for me.

1. Depositing Funds

You can fund the wallet by buying crypto directly or transferring from another wallet. I prefer transferring from Arbitrum One or Bitcoin networks to Ready using the "Transfer from another chain" feature.

Note for Metal users: You get up to $100/month in bridge fee refunds, credited weekly.

2. Earning Yield (DeFi)

Inside the app, go to the Earn tab. You will see options like "Lend & Earn" or "Liquid Staking."

Simple Method: Click "Lend USDC.e" and hit invest.

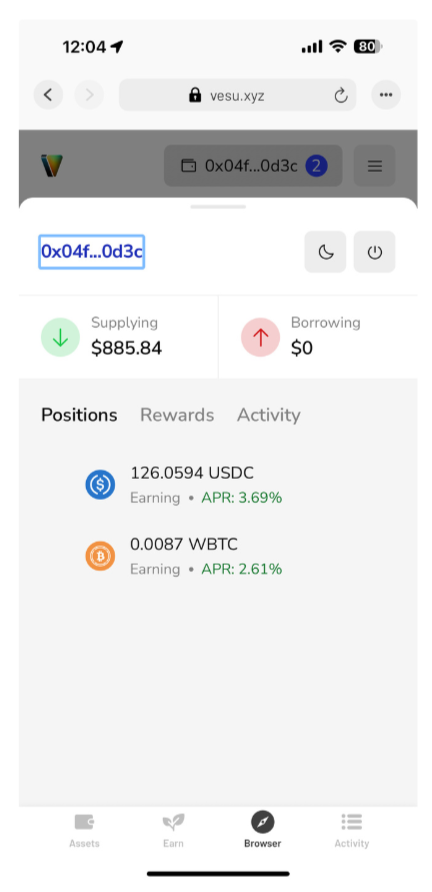

Advanced Method (Browser): I use a dApp called Vesu (accessible via the in-app browser).

Using Vesu for Yields

Yields on Vesu

Currently, I am getting roughly 4.79% APR on USDC and 3.48% on BTC. On top of this, because of the Starknet DeFi Spring campaign, many of these vaults offer bonus APY paid in STRK tokens.

The Spending Workflow

Since this is a debit card, you need to "load" it.

Deposit assets into the wallet.

Swap into USDC for Spending or for Stablecoin yields.

Spend via the physical card.

Spending on Ready Card

I’ve used the card for gym memberships, Squarespace subscriptions, supermarkets, and bars. It works almost everywhere except for restricted categories like gambling or money transfers.

Final Verdict

If you are looking for a way to ‘off-ramp’ your crypto while earning yield on your idle assets, Ready is a strong contender—especially if you are willing to use the Starknet ecosystem. The Metal card is a no-brainer if you can maximise the first month's spend to offset the annual fee.

Next Steps: If you'd like to purchase the Metal card, remember to use code YT-305QFU for 30% off.

If you gained something out of this article, please follow me on my socials and share your ideas with me!