Trust Bank Interest Rates Update: Is It Still Worth Using?

Trust Bank recently revised its interest rates in Singapore. This 2026 review explains what changed, how the savings plans compare, and whether Trust Bank is still worth using.

If you’ve been following the channel for a while, you’ll know that I’ve generally been a fan of Trust Bank. They’ve introduced features that people actually want to use — or at least features that have worked well for me personally.

But with their latest interest rate revision, I found myself re-evaluating whether Trust still makes sense as a place to park my savings, or whether there are better ways to maximise my money elsewhere.

A few days ago, I received an email from Trust Bank announcing another round of changes to their savings account interest rates — and this time, the changes are worth paying attention to.

A Quick Recap: What Changed?

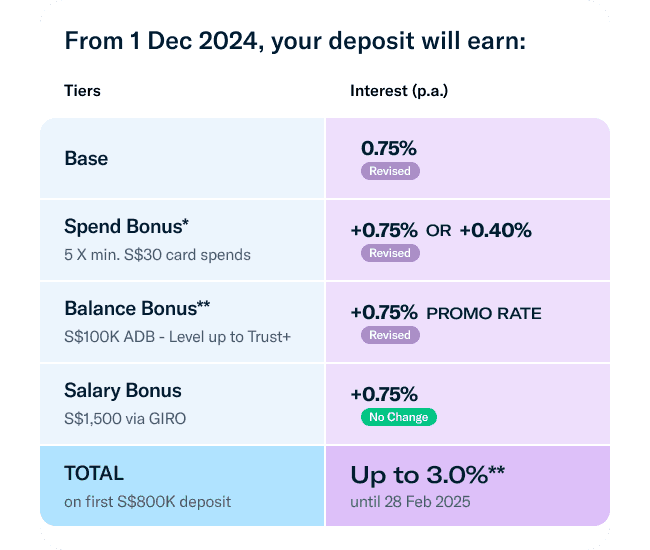

The previous revision in December 2024 already reduced Trust’s interest rates to:

0.75% base interest

An additional 0.75% bonus for NTUC union members

Or 0.4% bonus for non-members

Trust Bank Interest Changes in 2024

While higher interest tiers were technically possible, the requirements were honestly quite difficult to hit for most people.

The Latest Revision (Effective 1 March 2026)

Now, Trust is cutting rates further:

Base interest drops from 0.1% to 0.05%

NTUC members: an additional 0.2% on spend

Non-members: an additional 0.1% on spend

With interest rates going in the wrong direction, it naturally raises a concern:

“Is your money still working hard enough for you?”

Work is already hard. The cost of living isn’t getting cheaper. Most of us are trying to retire earlier, not later — so every percentage point matters.

The 3 Trust Bank Savings Plans Explained

Trust Bank currently offers three different savings plans:

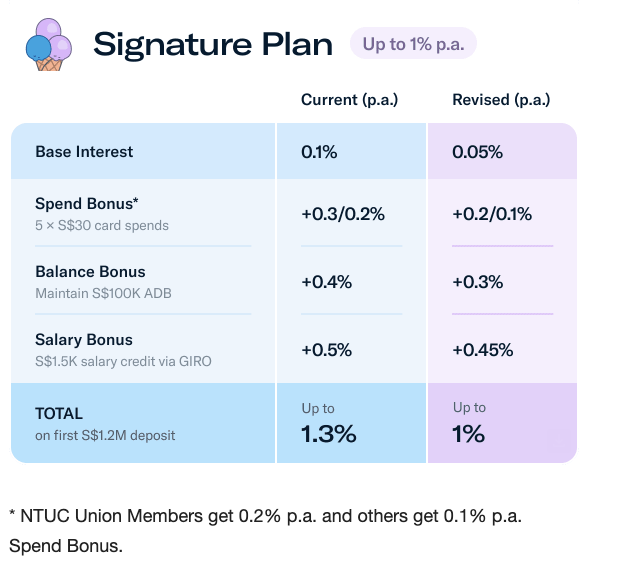

Signature Plan

Flex Plan

Zen Plan

Ironically, more choices don’t always help. For many people, it leads to confusion or decision paralysis. So let’s break down who each plan is really for.

1. Signature Plan — Familiar, But Less Competitive

The Signature Plan is closest to Trust’s old structure.

Trust Bank Signature Plan

To earn a higher bonus interest, you’ll need:

At least 5 Card Spends of S$30

Average Daily Balance(ABD) of S$100,000 or more

S$1,500 of Monthly Salary Crediting

This structure should look very familiar — it’s almost identical to traditional high-interest savings accounts, such as UOB ONE, which also require salary crediting, card spend, and minimum balances.

Quick Comparison: Trust vs UOB ONE

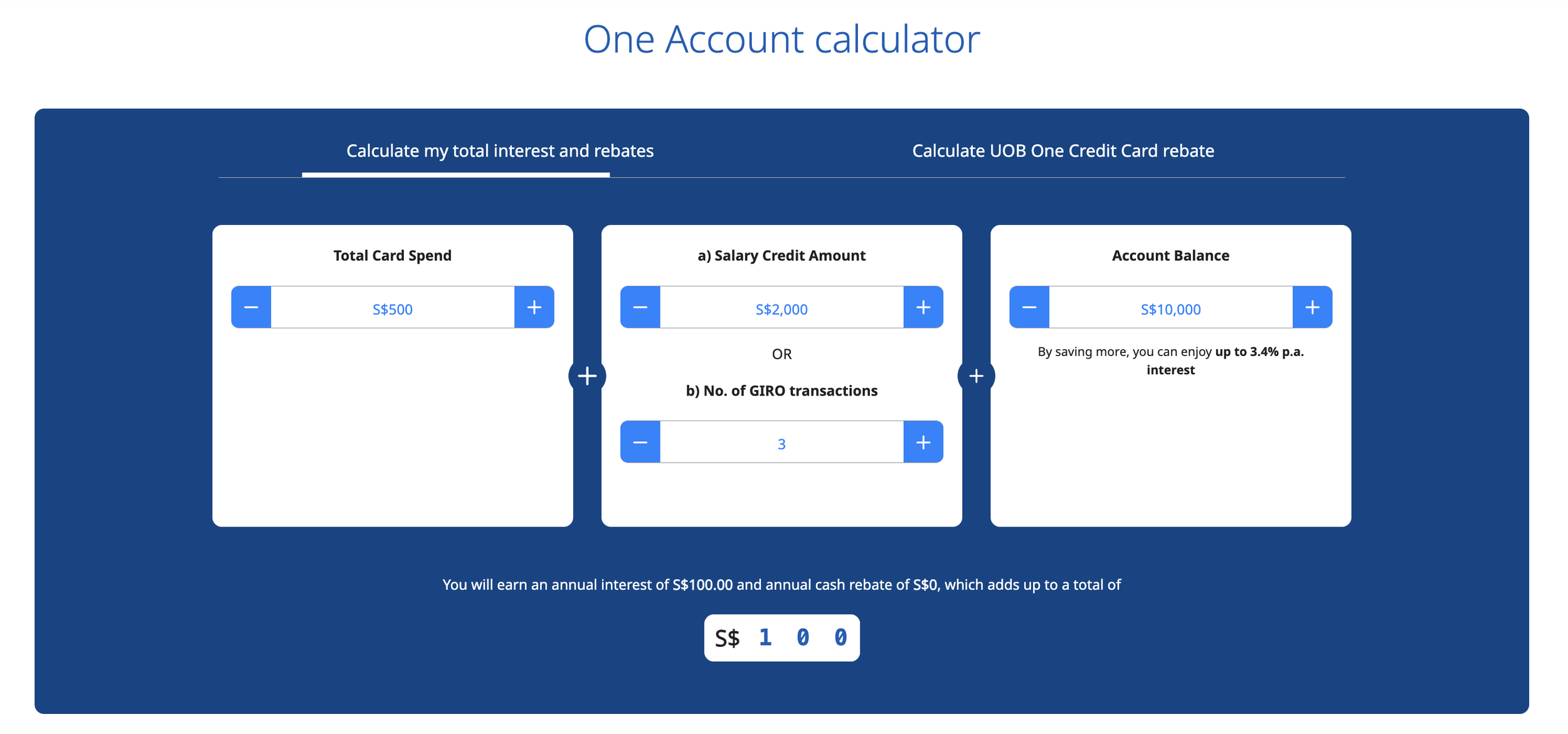

Assuming:

Both users credit salary

Both spend S$500/month

Balance of S$10,000

UOB ONE

Earns roughly S$100/year

UOB ONE Account Annual Interest

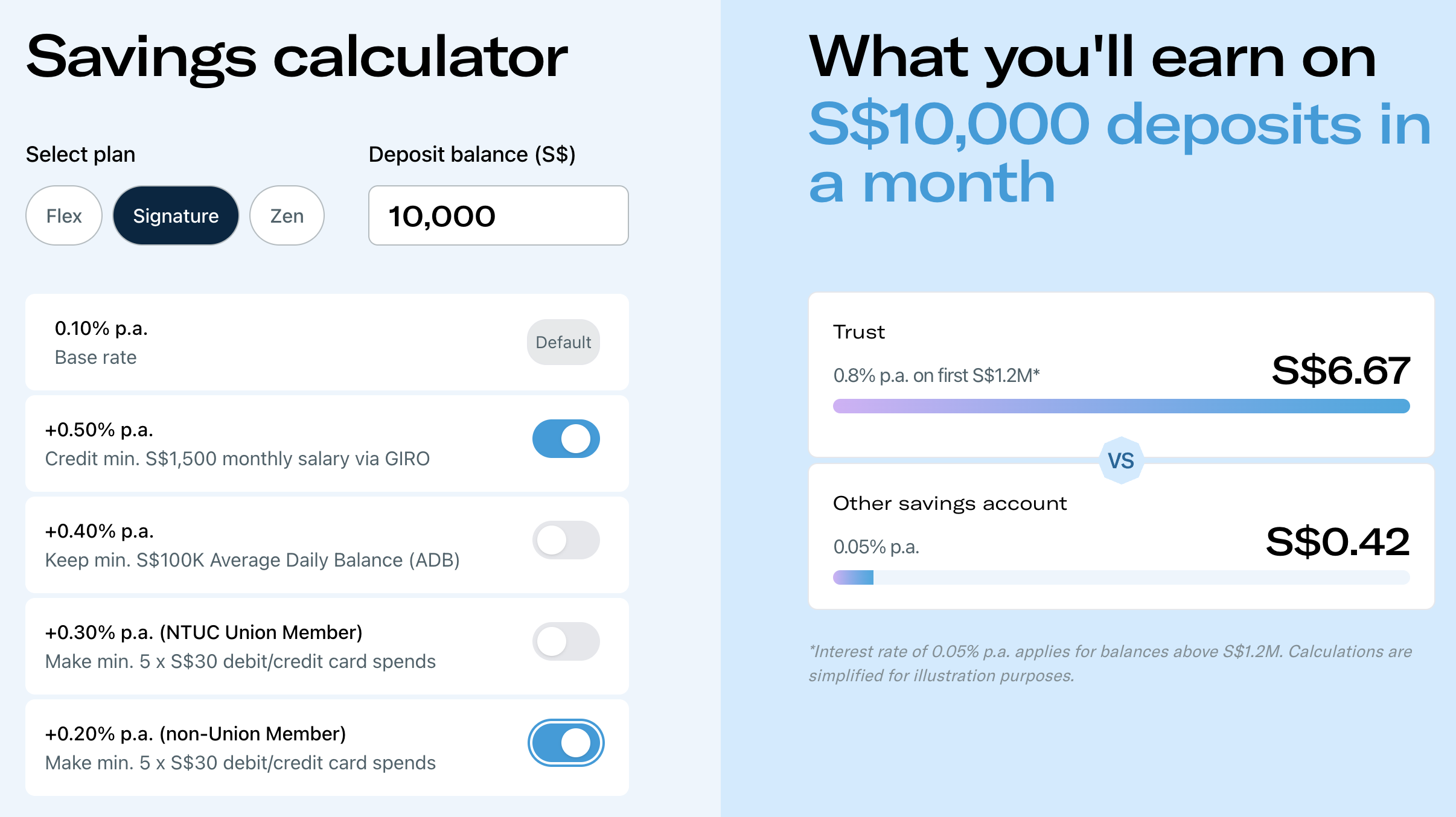

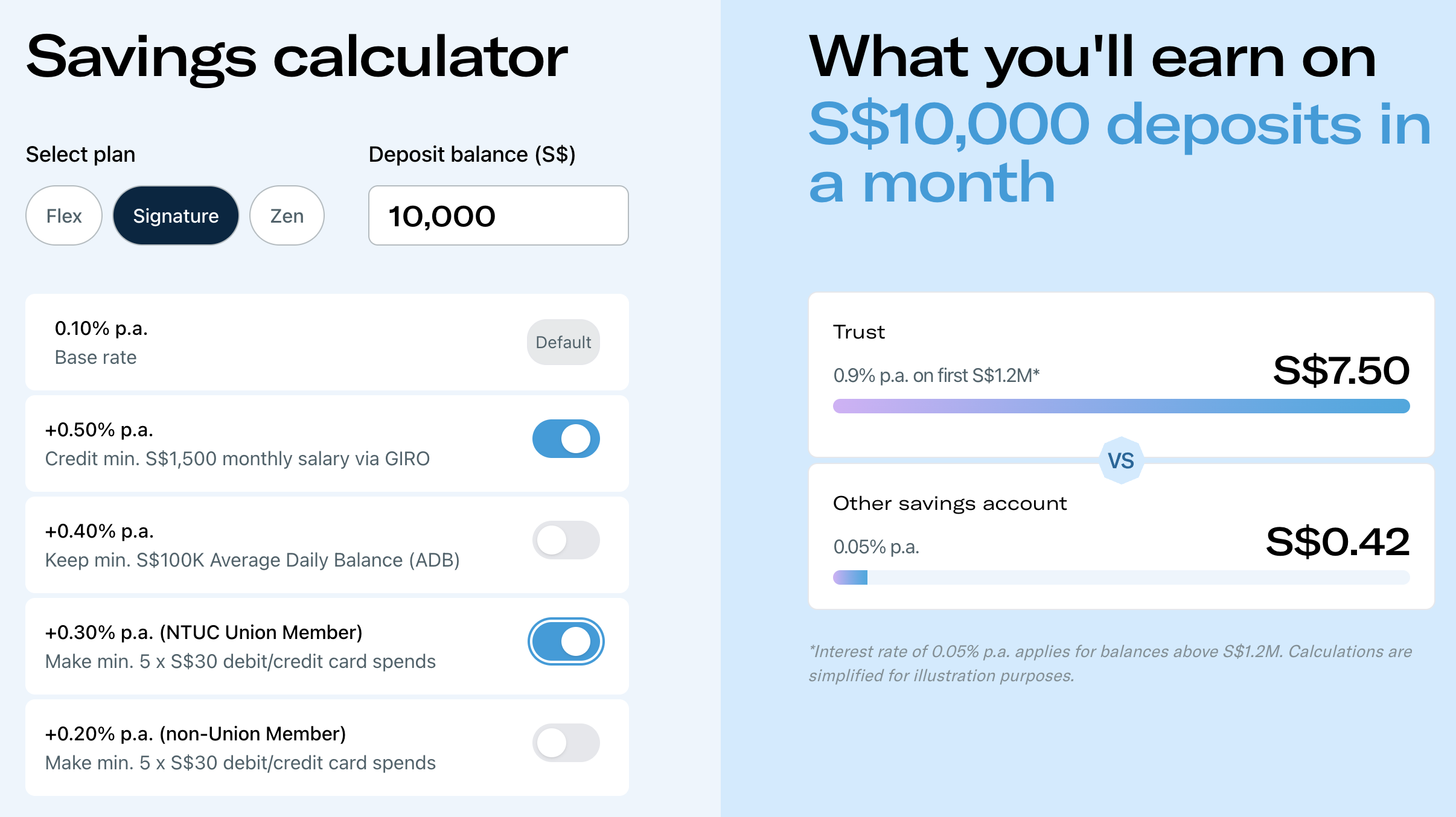

Trust Signature

Earns about S$6.67/month (Non-NTUC Union Member) or $7.50/month (NTUC Union Member)

Annual Total: ~S$80 - $90/year

Interest rate for Non-NTUC Union Member on Trust Signature Plan

Interest rate for NTUC Union Member on Trust Signature Plan

It’s not terrible, but it’s clearly less competitive. I’ll leave calculator links on the site so you can plug in your own numbers and see what makes sense for you.

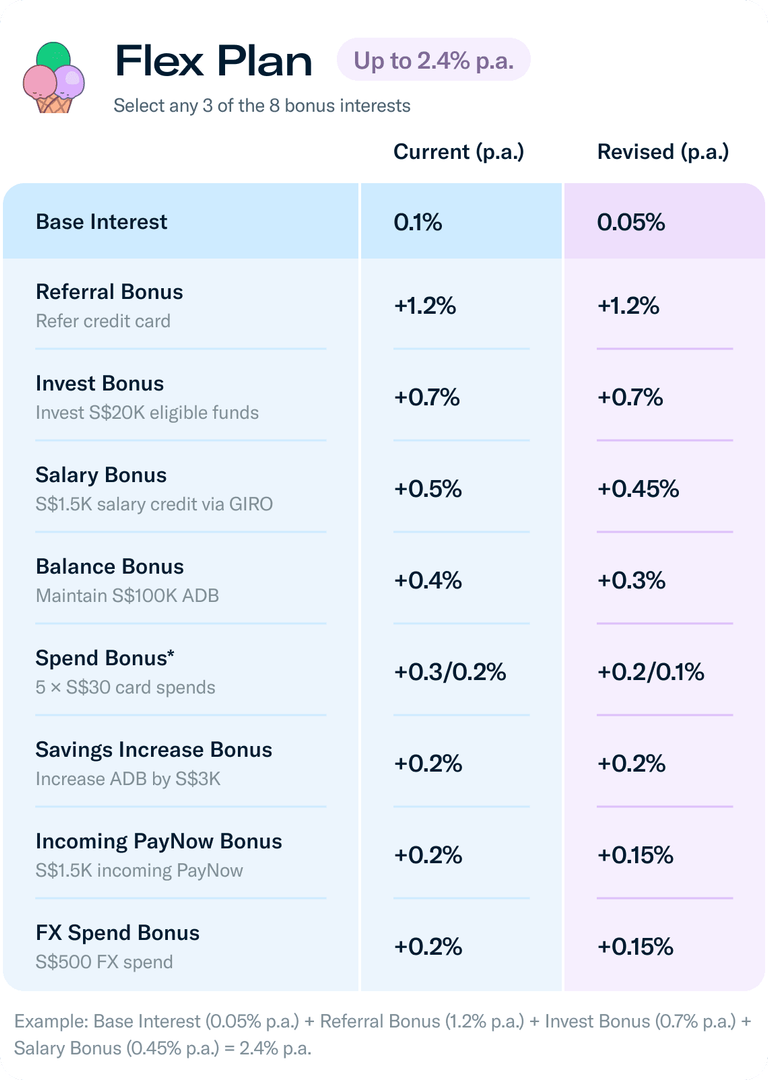

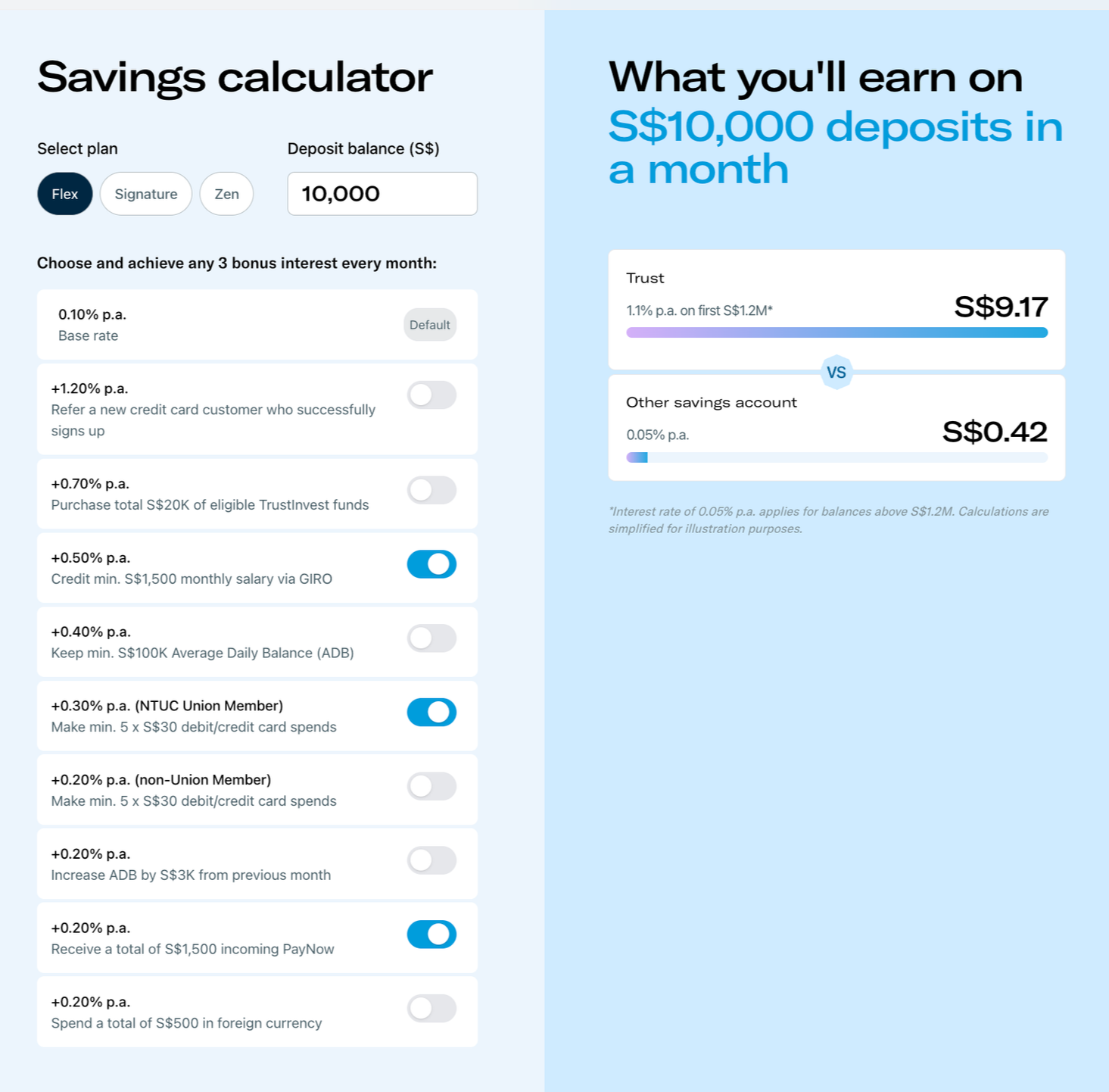

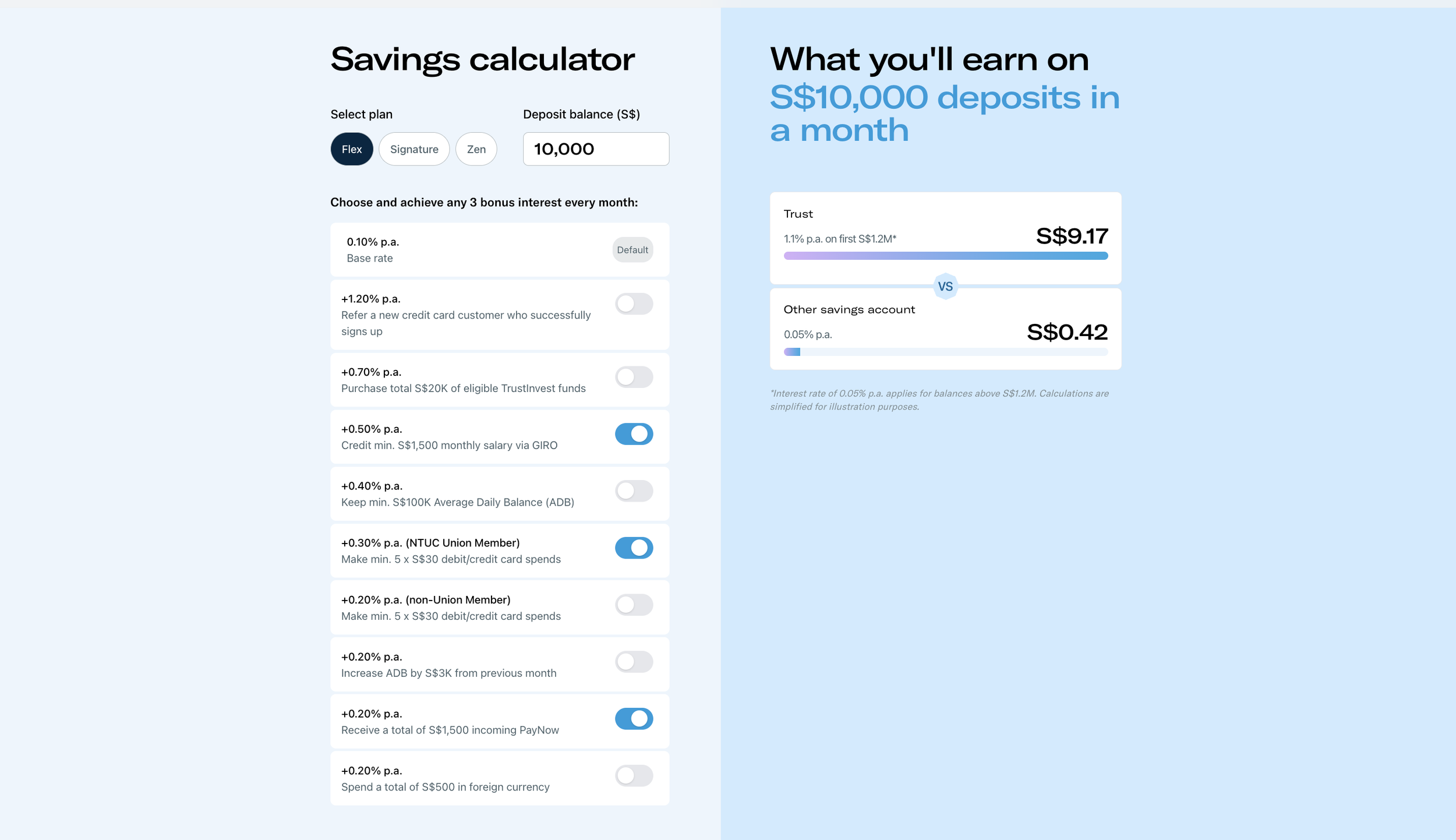

2. Flex Plan — Gamified, But Tricky

The Flex Plan is where things get interesting — and slightly complicated.

This plan “gamifies” savings by letting you choose 3 missions (Trust calls them categories) to earn bonus interest. Each mission comes with a different interest boost.

Trust Bank Flex Plan Interest Rates

Flex Plan Missions:

Base rate: 0.1%

Refer a friend: +1.2%

Invest S$20,000 in TrustInvest: +0.7%

Salary credit S$1,500: +0.5%

ADB ≥ S$100,000: +0.4%

5 × S$30 card spends:

+0.3% (NTUC members)

+0.2% (non-members)

Increase ADB by S$3,000: +0.2%

Receive S$1,500 via PayNow: +0.2%

Spend S$500 in foreign currency: +0.2%

As you can see, lots of options, which also means a lot of mental overhead.

The “Best” Trust Bank Flex Plan Setup That Actually Works

In my opinion, the Flex Plan only makes sense if you keep it simple:

S$1,500 salary credit

Debit/credit card spend

PayNow inflow

That gives you:

0.1% base

+0.5% salary credit

+0.3% card spend (or 0.2% non-member)

+0.2% PayNow

On a S$10,000 balance, this gets you almost the same interest as UOB ONE, with one big difference:

Best way to maximize your money with Trust Bank Flex Plan

👉 Trust only requires ~S$150 spend,

👉 while UOB ONE requires S$500.

The difference in interest is about S$1 max — which honestly isn’t bad.

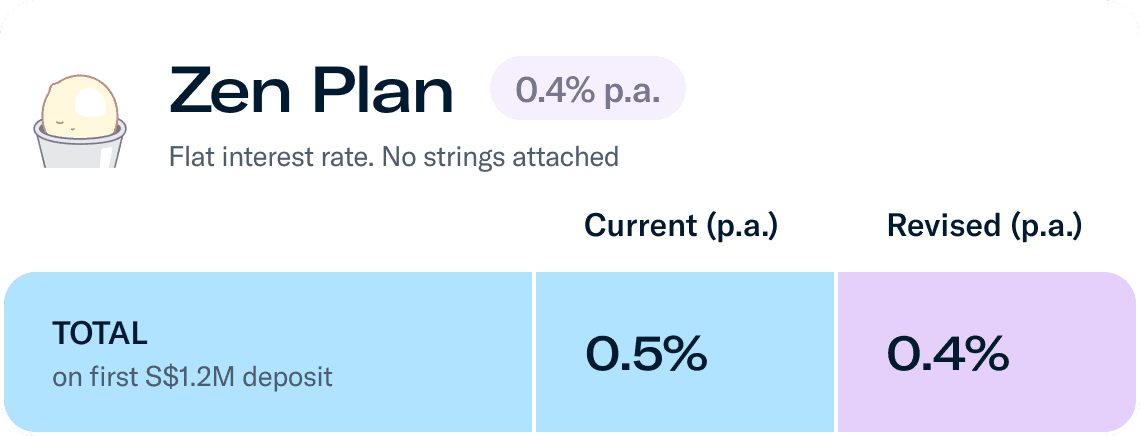

3. Zen Plan — Simple and No Stress

The Zen Plan lives up to its name.

Flat 0.5% interest

No salary credit

No spending requirements

No conditions

It’s not exciting, but it’s predictable — and for some people, that’s exactly what they want.

So… Should You Stay With Trust?

These changes force us to think more carefully about how we structure our finances.

Personally, savings interest is not the main reason I use Trust.

I don’t keep much SGD lying around. As I’ve shared in previous videos, I’m using stablecoins to earn higher yields, and that strategy has been working well for me.

What I Actually Use Trust For:

Overseas Spending

Category Spending with up to 15% cashback

And here’s the silver lining 👇

Cashback Card Upgrade (Good News!)

From 1 March 2026, while savings rates drop, the Trust Cashback Card actually improves.

Previously:

You didn’t earn the 1% base cashback on selected categories if you already got the 15% bonus

After 1 March 2026:

You’ll get both:

1% base cashback

+ category bonus

On top of that:

0% FX fees

Excellent exchange rates that beat most neo-banks and broker cards

This has become my go-to card for work travel, and I don’t see that changing anytime soon.

Final Take

For my personal use case:

Trust Cashback Card → still very worth it

Salary credit & savings → UOB ONE works better for me

If you’re considering Trust — or haven’t tried it yet — use promo code: 2KAMXV1S to get up to $1,888 worth of cashback!

Share this with a friend who’s deciding whether to use Trust.

As always — stay safe, invest safe, and I’ll see you in the next one.