MooMoo CashPlus & SmartSave Singapore Review: Maximise Idle Cash and Earn Daily Interest

If you have idle cash sitting in your brokerage account, you could be losing out on anywhere from 1–3% in interest. Considering the median salary in Singapore ($5,800) and the investing rule-of-thumb (10–20% allocation), that translates to potentially losing $60 to $300 per year on uninvested funds.

My name is Jorden, and on this blog, I focus on personal finance and share my own investment diary. I started a small series back in September with a simple goal: to debunk the myth that you need massive capital to start investing.

We’re doing this by consistently investing just $200 a month into the Singapore market. Today, I’m sharing the latest update on our portfolio and reviewing the tool I’m using to make every single dollar work: the MooMoo CashPlus and SmartSave feature.

Since September, I started this small series, investing $200 per month into the Singapore market for now, because there are friends telling me that they are not investing, because they don’t have capital.

On the other side of the argument is that with new brokers and technologies now, investing is becoming easier and more accessible to regular folks like me and you.

Nov & Dec Update on Small Investment Account

Just a quick update on our portfolio right now, we are at S$1047.51 in total account value, and this is split between S$693 in SG stocks, S$14 in US stocks, which I got for free as a bonus and S$354 in funds

Nov & Dec Update on Small Investment Account Update

For Nov and Dec, I’m not purchasing any shares right now, because I want to accumulate some money and make a purchase in the next couple of months, which will help our portfolio a lot more and ideally grow this account fast enough so I can retire!

As usual, I deposited $200 at the beginning of Dec and just made one more today. But something different I did was to put this idle cash into CashPlus and activate SmartSave.

What is MooMoo CashPlus & MooMoo SmartSave?

CashPlus is a wealth management tool that invests your idle cash into short-term debt instruments, which gives you interest while maintaining the principal value. And once your funds are in CashPlus, you can activate SmartSave.

What SmartSave does is move your uninvested cash into CashPlus. This enables you to earn some interest daily, and when you purchase shares in the respective currencies, it will automatically redeem them from CashPlus.

Now it seems a little confusing, but here’s how everything works in an ecosystem, which can help boost your funds more.

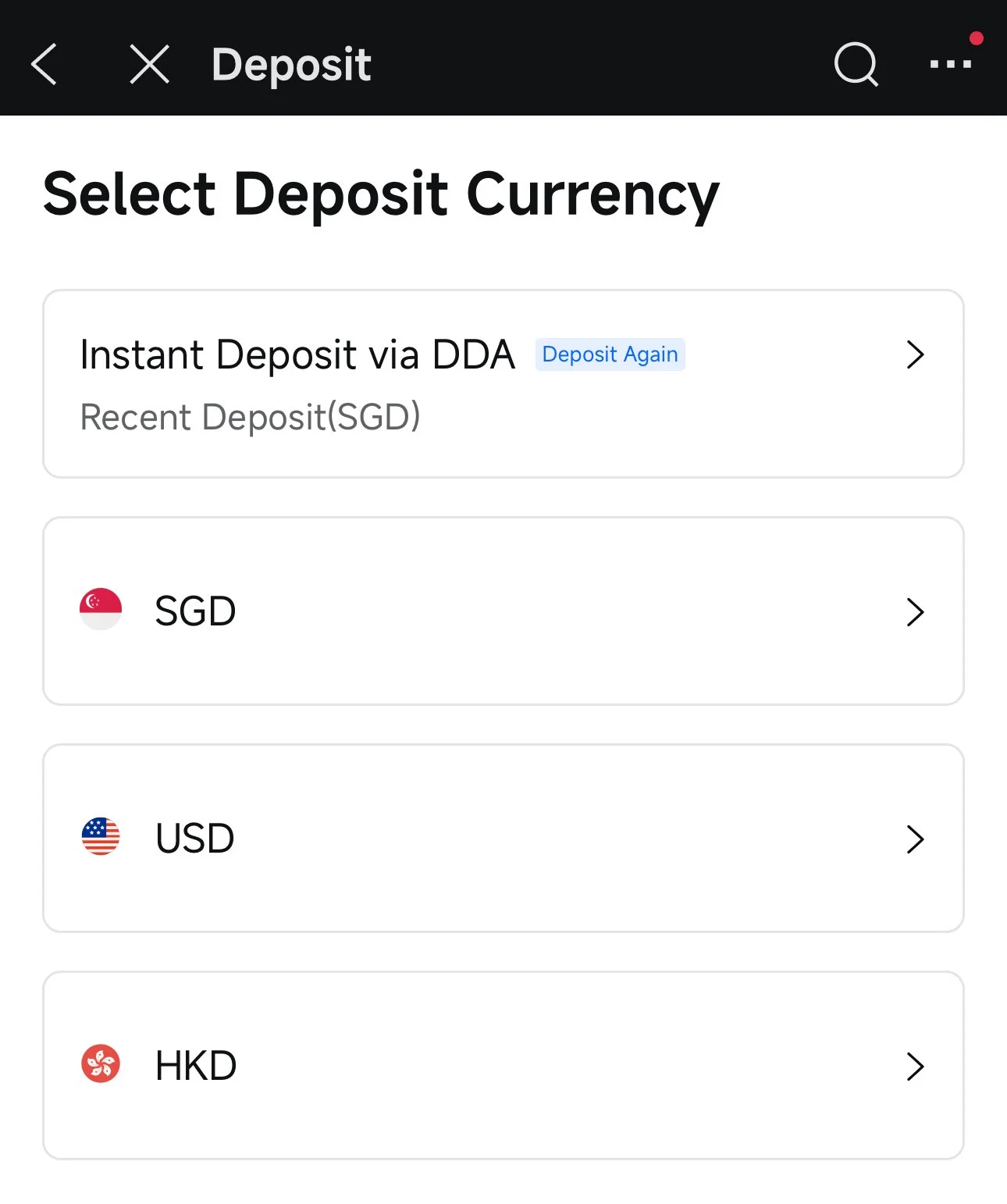

When you deposit money into MooMoo, you do it via DDA or bank transfer. Once the funds are in, you can decide if you want to purchase a stock or an ETF. Otherwise, the money stays in there doing nothing much.

Depositing into MooMoo via DDA

Let me take you through how this works and how you can set it up yourself, and even experiment when you have the time.

Setting up MooMoo CashPlus

Accessing MooMoo CashPlus

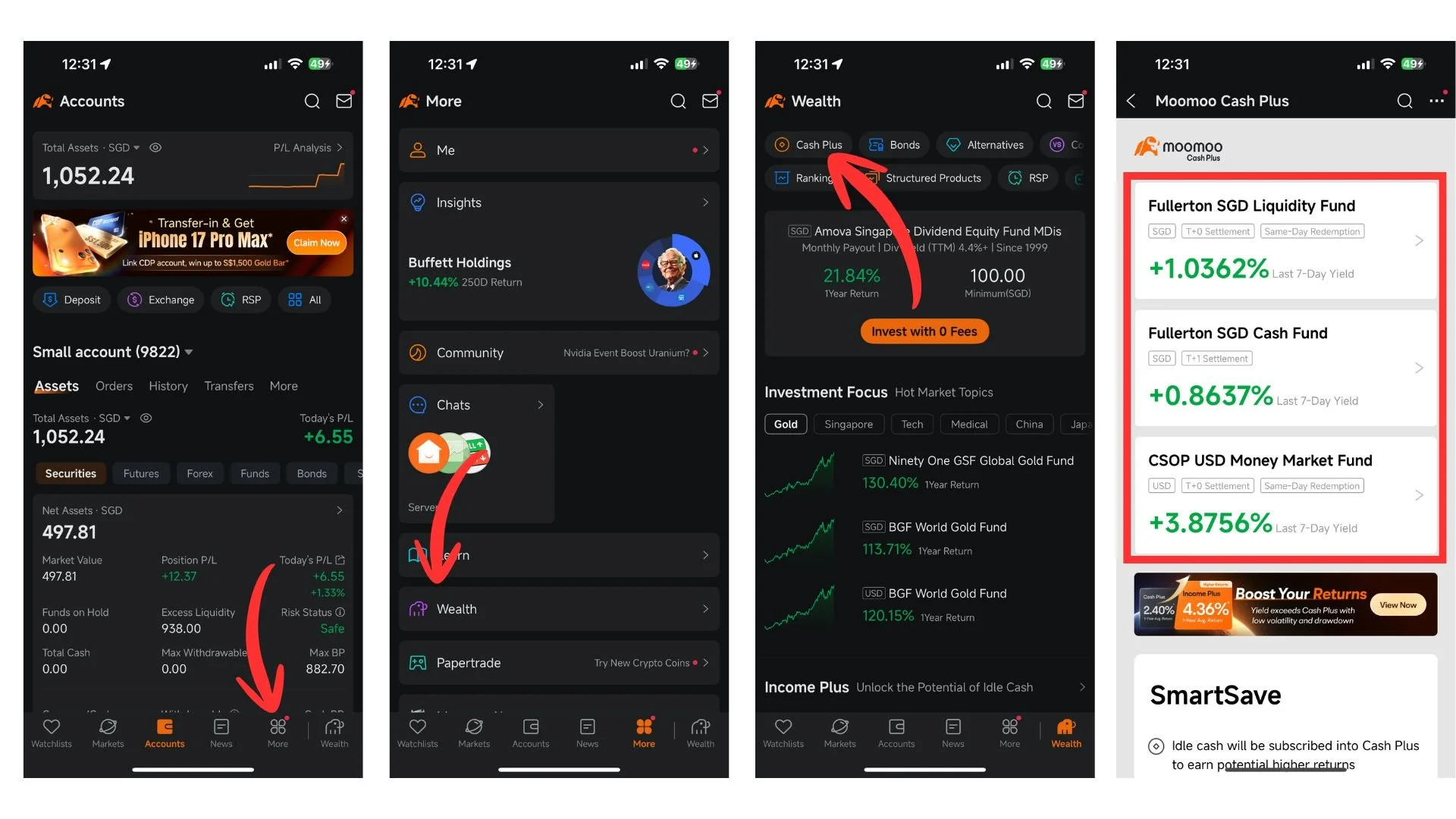

On the MooMoo main page, we will use the bottom to navigate to “More”, and then we click on “Wealth”.

On this page, it shows us the different wealth management products available for you to explore and try if something catches your eye.

Then we go to “CashPlus” at the top left corner, which brings up the different funds that MooMoo is offering right now.

There are 2 for SGD, which are the SG Liquidity Fund and SG Cash Fund. These two funds have 2 different purposes, have different backings, different interests and different redemption times.

MooMoo CashPlus SG Liquidity Fund and Cash Fund

Depending on what you prefer and your investment strategy, you might pick one over the other, but the biggest difference here is the time for withdrawal and interest. With higher interest, the withdrawal time is T+1, which means Transaction Day + 1. And this might be crucial if you need your funds urgently, because if you make the transaction on Monday, you will only receive them on Tuesday.

However, if it’s T+0 like the liquidity fund, then your funds are redeemed almost instantly.

If we go into the fund, we can see the statistics of the fund like the returns for the last day, week, month, 3 months and 6 months. It also shows that for every $10,000 invested, the earnings you would have gotten in the last couple of days.

CashPlus SG Fund Holdings

And even below that, we can see the holdings of this fund as well.

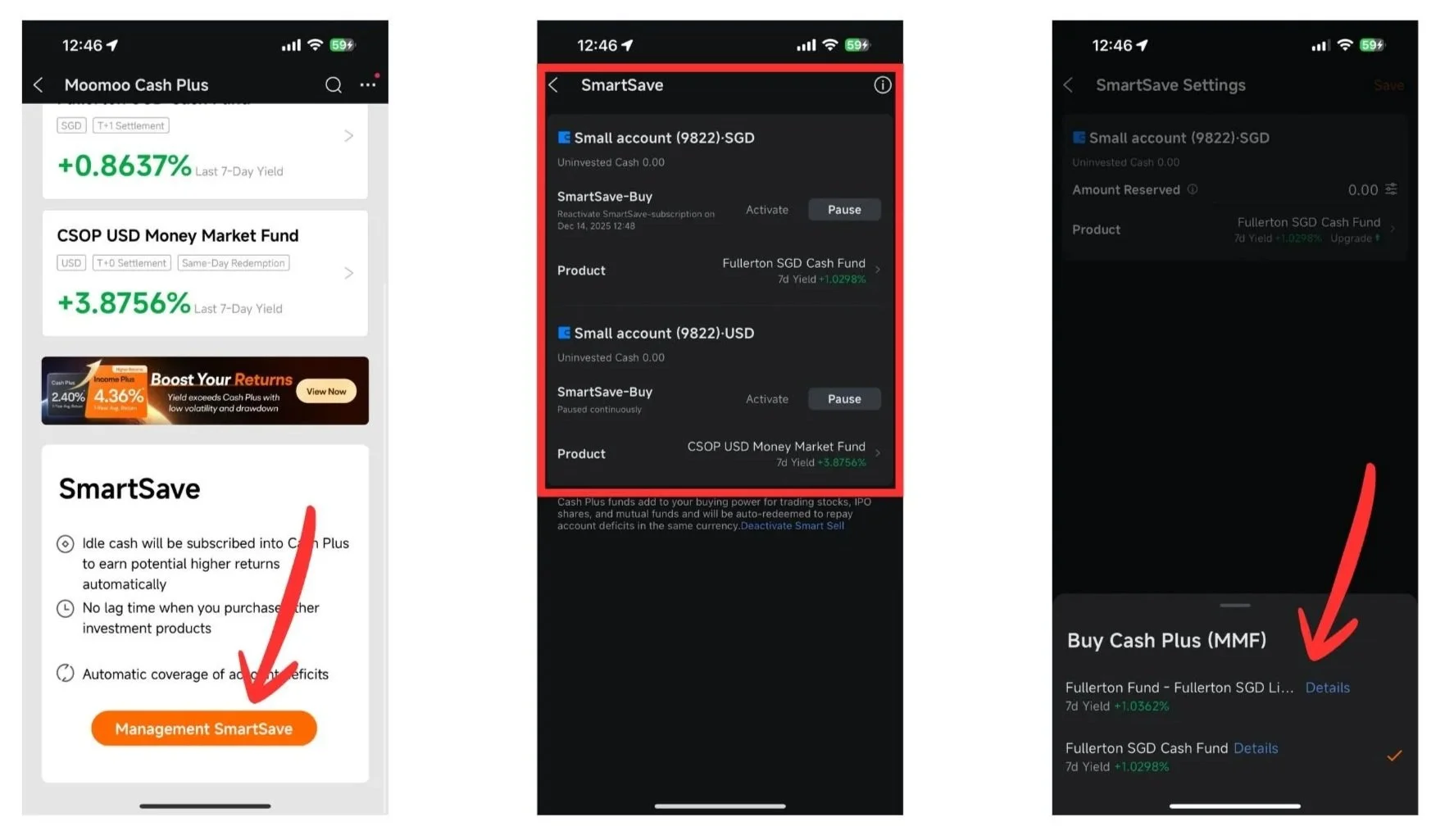

Back to the CashPlus page, this is where we can set up SmartSave. What SmartSave enables you to purchase stocks even if your money is still in the CashPlus account. This means your money is always efficiently working and earning interest, and when you want to purchase stocks, it will automatically do the settlement.

Setting up SmartSave

So we’ll tap on “Management SmartSave”, and this opens a page with the different funds you can set up SmartSave with. If we tap into the product section for SGD, it gives us an option to set up SmartSave with either the liquidity fund or the Cash Fund. Selecting either is a personal choice.

MooMoo CashPlus P&L so far!

So I have had the fund subscribed for a while, and the really cool part now is that I can see the performance of how the fund has been doing, with the actual P&L.

If you look at the image below, you can see that Year to Date (YTD), I have earned $0.97 from Aug to Dec. And this is because the interest rates have been going down, which means less interest from the fund as well.

Earnings from CashPlus

Having said that, if we do have spare cash lying around, this might be something to consider since it’s no-frills, unlike bank interest, where you need to do certain actions to get interest boosted.

Earning $0.97 might seem small, but it's crucial proof that the little things add up. This small gain, compounded with our consistent $200 monthly investment, is the engine driving our portfolio.

We are actively debunking the myth that you need massive capital to start investing. What we need is consistency and efficiency—making every dollar work, even the idle ones. That's what SmartSave helps us achieve.

If you are looking to try out SmartSave, I have left links in the description down below and in the comments where you can try out MooMoo for yourself and get some bonuses when you use my link!

I'll be back next month with an update on what we finally purchase with our accumulated funds. If you want to see if this account actually helps me retire, make sure you subscribe so you don't miss the next move. Until then, keep your cash working hard!